An FHA loan is a government-backed mortgage with less stringent financial requirements than other loans. You may qualify for an FHA loan if you have debt or a lower credit score. You might even be able to get an FHA loan with a bankruptcy or other financial issue on your record.

FHA loans are backed by the Federal Housing Administration (FHA), an agency under the jurisdiction of the Department of Housing and Urban Development (HUD).

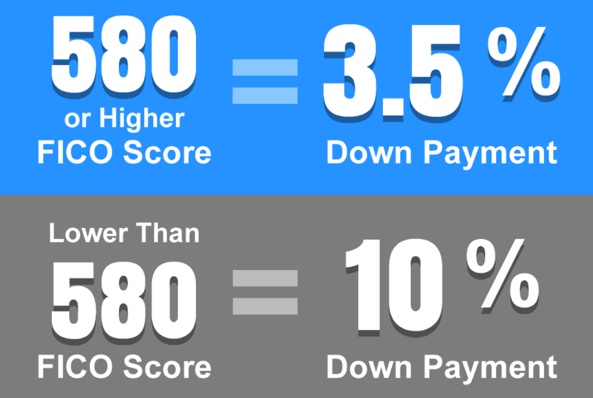

FHA loans allow home buyers to borrow up to a certain percentage of a home’s value, depending on their credit score. Home buyers who have a credit score over 580 can borrow up to 96.5% of a home’s value with an FHA loan. Home buyers whose credit scores are between 500 – 579 can still qualify for an FHA loan with a 10% down payment.

Why Are FHA Loans Attractive?

The option of a low down payment and more lenient credit requirements can make FHA loans attractive, particularly for first-time home buyers, although you don’t have to be a first-time home buyer in order to qualify. Here are some benefits of FHA loans:

- Credit score requirements are lower compared to other loans.

- Your lender can accept a lower down payment.

- You could still qualify for an FHA loan if you have a bankruptcy or other financial issues in your history.

- FHA closing costs can often be rolled into your loan.

FHA Loan Requirements

There are certain requirements borrowers must meet to qualify for an FHA loan, including:

- The home you consider must be appraised by an FHA-approved appraiser.

- You can only get a new FHA loan if the home you consider will be your primary residence, which means that it can’t be an investment property or second home.

- You must occupy the property within 60 days of closing.

- An inspection must occur, and the inspection must report whether minimum property standards are met.

-According to Rocket Mortgage

0 Comments